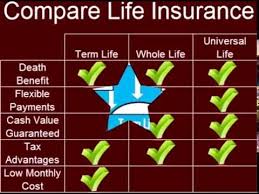

When In regards to insurance, also we’ve got life and general insurance policies. The life cover is an insurance policy in which you get insured to get a certain period as agreed. This coverage is so affordable in comparison with whole life insurance policy. But when it comes to whole lifetime insurance coverage, it’d survive till the evening that you are pass on. Life time policies are costly given that they’d take decades. You may choose such a policy that goes against the top interest rates.

Exactly why a lifetime policy?

Additionally, it Is potential to do some Life Insurance Comparison if you have dependants who’ve financial demands. Majority of home owners might take such a pay whenever they have young kiddies, and the term will expire when the children move outside to endure to on their own. Once the children now are financially stable, they would not need to continue with the insurance plan premiums and the lien would possess the donations.

How much could you spend on an insurance policy?

Knowing what you need to the family is quite Important. In addition, this is 1 method to know what sort of insurance will work best for you. You’ll have guidance online or goto the insurance carrier immediately. They’d find a way to obey you and suit your needs using a dependable cover. The insurance policy plan type is dependent on several circumstances. It is possible to have a general and life insurance policy quote depending on personal special needs along with the quantity of premiums you can spend.